When push-comes-to-shove, people love to donate, especially when they believe that their donation (be it money, time, food or possessions) will make a real difference. While online charity and fundraising platforms have made it easier than ever before to donate to causes, charities and non-profits, web-based philanthropy still has plenty of room for improvement.

Today, donors, especially those who have grown up in the Web 2.0 Era, are frustrated by the lack of enjoyable giving experiences on the Web. Not to mention that, with the accessibility of information on the Web today, donors want more accountability in their dealings with non-profits and, in turn, are more focused on outcomes. In other words, they want to know if (and how) their donations are making an impact.

This is the way Rutul Dav? and Ty Walrod have come to see the non-profit fundraising space and why they?re today launching Bright Funds ? a platform that aims to change the way people give to charity. Part of the new wave of ?venture for good operations,? Bright Funds seeks to differentiate itself from the competition by combining the social objectives of the non-profit world with elements of private investing to create what it hopes can be the ?Vanguard of charitable giving.?

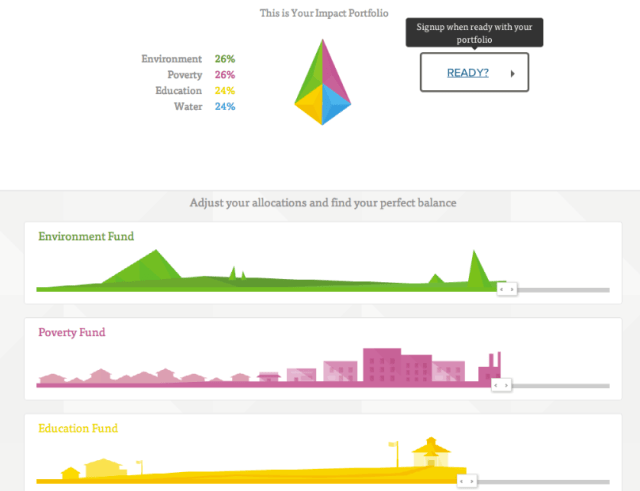

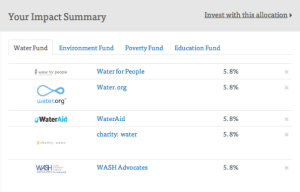

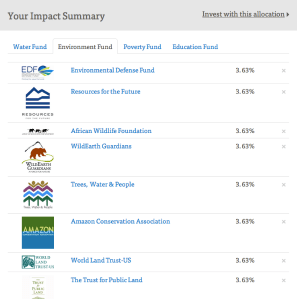

The platform creates a set of ?mutual funds? comprised of between 10 and 15 non-profit organizations and allows users to invest in these funds, while building personalized investment portfolios centered around particular causes. At launch, the startup?s mutual funds focus on four areas: Poverty relief, water, education and the environment. The education fund, for example, includes non-profits like Teach For America, the KIPP Foundation, Jumpstart and iMentor and groups its chosen organizations into groups, like ?Resources and Infrastructure? or ?Accessible Education.?

Each of the non-profits falls into one of the subgroups (or ?facets?), with the premise being that users can invest more holistically in education, touching on each of its major categories, rather than focusing all of their investments in one area, like Resources and Infrastructure. Users can also pick and choose between the non-profits offered by Bright Funds, investing in two from one group, three from another and so on.

The idea, Walrod tells us, is to give a more personalized feel to charitable donations, allowing users to curate their investments in a portfolio allocating 60 percent of their donations to water and 40 percent to education, for example, just as they would when investing in the public markets.

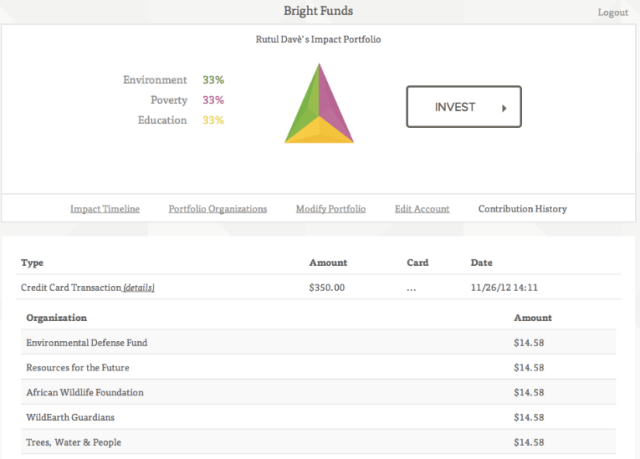

In turn, this means that, in a single transaction (of any amount, Bright Funds doesn?t limit donations on either end), users can have their contribution evenly spread among the selected non-profits in each fund. If investors want to double their contribution to water, Bright Funds automatically disperses that among users? portfolio companies and donors can make one-time or recurring investments.

As to cost, at launch, opening and maintaining a Bright Funds account is free and donations are fully tax deductible. The startup generates receipts for users, which are available once investments are made and can be accessed from any Bright Funds account. On the non-profit side, Bright Funds charges a ?fundraising fee? of 7.5 percent from its organizations, which covers credit card processing and transaction fees and so on. At this point, donors can?t yet pay directly from their bank accounts, but the startup hopes to add this support in the coming months.

Another cool feature of the service is that it offers one-click tax reporting, so, because it tracks every dollar given to non-profits, at the end of the year (or at any time), Bright Funds can generate a free report that donors can use as a record of giving for the year.

In these ways, Bright Funds really does start to feel like a non-profit, tax deductible version of private investing and asset management. Walrod says he likes to think of Bright Funds as a broker and users? donations as their investment in a mutual fund, with each tailored to ?investment objectives? ? being in this case, rather than your own financial goals, the causes users want to support.

In these ways, Bright Funds really does start to feel like a non-profit, tax deductible version of private investing and asset management. Walrod says he likes to think of Bright Funds as a broker and users? donations as their investment in a mutual fund, with each tailored to ?investment objectives? ? being in this case, rather than your own financial goals, the causes users want to support.

So, like any good broker, asset management service or financial provider, Bright Funds wants to channel the noise that?s inherent to the market as a whole into signal, surfacing the best investment opportunities. For Bright Funds, this means whittling the million-odd non-profits in the U.S. down to the cream of the crop.

To do so, the startup has used research and reviews from independent organizations like GiveWell, Charity Navigator, Philanthropedia and the American Institute of Philanthropy to select its first 50 non-profits. (However, it will be adding two additional funds and a handful of new non-profits beginning in 2013.) It?s a good first step, but overcoming the lack of trust surrounding charitable giving is likely going to require additional data sources.

To that point: Across the board, users want to know how their donations are actually affecting the organizations or causes they give to, so as part of its personal accounts, Bright Funds offers a streaming feed (a la Facebook?s news feed) that enables non-profits to keep their donors up-to-date on outcomes.

For example, if a user chooses to donate to Water.org as part of the startup?s ?Water Fund,? Water.org will be able to share progress reports, showing them that their donation went towards building a well in rural Bangladesh, which, in turn, allowed 15 families to get access to clean water for the first time. The non-profit could then introduce the donor to those 15 families, allowing them to feel like they?re more active participants in the process and to see how, in detail, their charity is making a difference.

For example, if a user chooses to donate to Water.org as part of the startup?s ?Water Fund,? Water.org will be able to share progress reports, showing them that their donation went towards building a well in rural Bangladesh, which, in turn, allowed 15 families to get access to clean water for the first time. The non-profit could then introduce the donor to those 15 families, allowing them to feel like they?re more active participants in the process and to see how, in detail, their charity is making a difference.

Beyond this social integration (which also allows users to share their portfolio with friends and family on Facebook and other social networks, including Yammer), Bright Funds offers employers a cloud-based, secure tool that they can integrate into payroll or employee benefit systems. The idea being to enable companies to match their employees? donations, while limiting IT costs and making it easy for employees to manage their accounts and for businesses to deploy this functionality without the overhead.

Bright Funds has raised $500K+ in seed funding to date and, while the round was initially closed, the founders have decided to continue bringing on investors. Call it a bridge round. The startup?s investors include Hattery, the San Francisco-based innovation and idea lab, as well as angels like Samasource founder and CEO Leila Janah ? to name a few. Janah also serves as an advisor to Bright Funds.

As to why she is optimistic about the startup?s potential, the Samasource founder said, ?Bright Funds combines the visibility of Mint.com with the trust of Vanguard into a single service that can improve the way we invest in non-profits and revolutionize the way people give to charity.?

Bright Funds is the trusted place for online giving, helping people invest in the causes that they care about. We bring a new approach to giving by providing a rewarding, innovative way for individuals and employees contribute to funds of outstanding non-profits.

? Learn moregrizzlies bronx zoo crash april 30 wwe extreme rules 2012 vontaze burfict jimmy kimmel amzn

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.